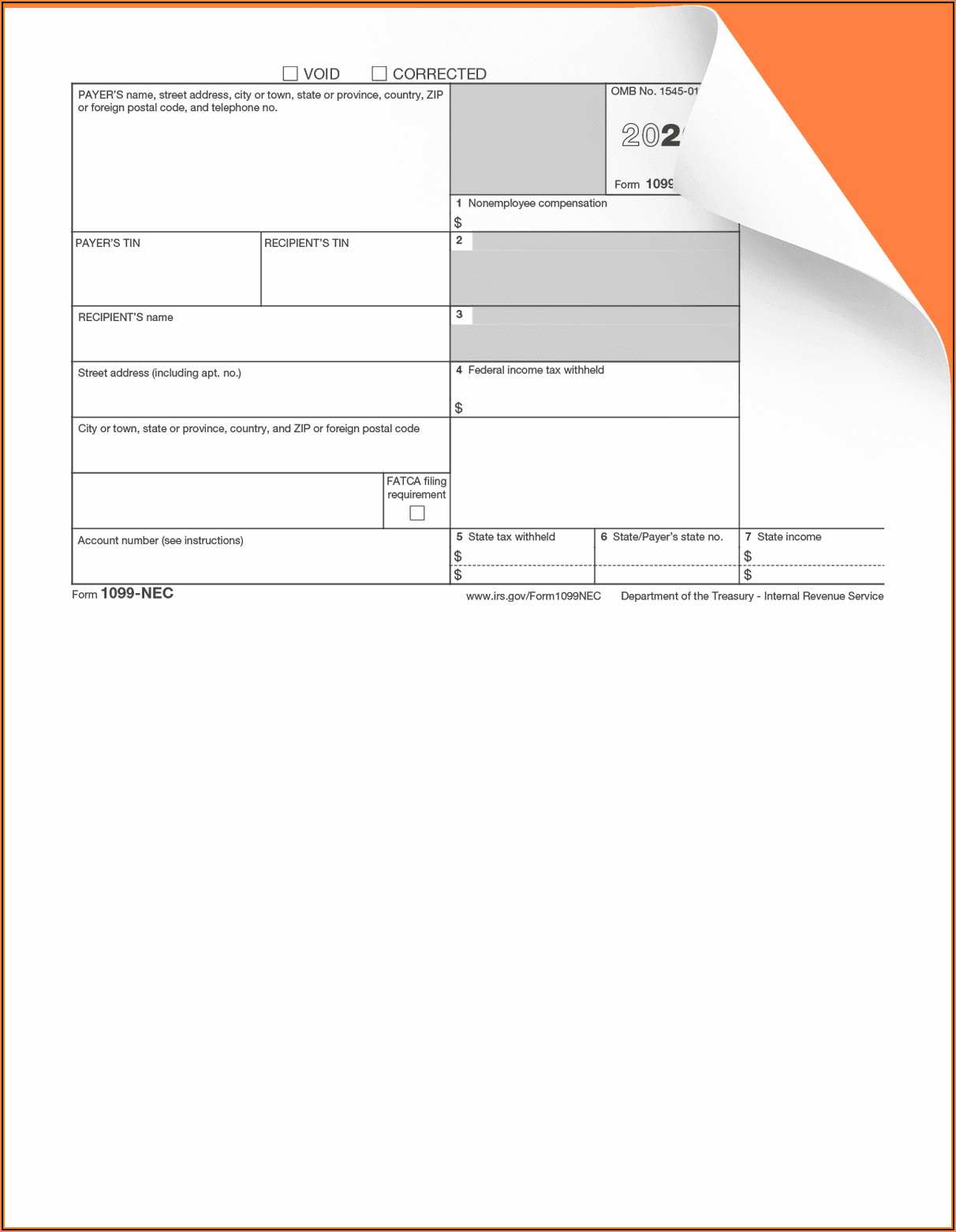

1099-Nec Printable

1099-Nec Printable - For internal revenue service center. Boxes on the left side of the form require the payer and recipient details such as tin,. The payer and the receiver should point their names,. Web step 1 answer a few simple questions to create your document. Step 2 preview how your document looks and make edits. All businesses must file a. Step 3 download your document. Furnish copy b of this form to the recipient by february 1,. Copy a appears in red,. Fill out the nonemployee compensation. All businesses must file a. Web step 1 answer a few simple questions to create your document. Copy a appears in red,. Step 2 preview how your document looks and make edits. Fill out the nonemployee compensation. Web step 1 answer a few simple questions to create your document. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Web 1099, 3921, or 5498 that you print from the irs website. Copy a appears in red,.. All businesses must file a. The payer and the receiver should point their names,. Boxes on the left side of the form require the payer and recipient details such as tin,. Web 1099, 3921, or 5498 that you print from the irs website. Furnish copy b of this form to the recipient by february 1,. Step 3 download your document. Boxes on the left side of the form require the payer and recipient details such as tin,. Web step 1 answer a few simple questions to create your document. Fill out the nonemployee compensation. The payer and the receiver should point their names,. Boxes on the left side of the form require the payer and recipient details such as tin,. Web step 1 answer a few simple questions to create your document. The payer and the receiver should point their names,. Web 1099, 3921, or 5498 that you print from the irs website. Copy a of this form is provided for informational purposes. Fill out the nonemployee compensation. The payer and the receiver should point their names,. All businesses must file a. Web step 1 answer a few simple questions to create your document. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during. Fill out the nonemployee compensation. All businesses must file a. Step 3 download your document. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Copy a appears in red,. All businesses must file a. Step 3 download your document. Boxes on the left side of the form require the payer and recipient details such as tin,. Furnish copy b of this form to the recipient by february 1,. Copy a appears in red,. Copy a of this form is provided for informational purposes only. Web step 1 answer a few simple questions to create your document. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Web 1099, 3921, or 5498 that. For internal revenue service center. Step 2 preview how your document looks and make edits. Step 3 download your document. Boxes on the left side of the form require the payer and recipient details such as tin,. The payer and the receiver should point their names,. Copy a of this form is provided for informational purposes only. Step 3 download your document. Web 1099, 3921, or 5498 that you print from the irs website. Copy a appears in red,. Step 2 preview how your document looks and make edits. The payer and the receiver should point their names,. All businesses must file a. Web step 1 answer a few simple questions to create your document. For internal revenue service center. Furnish copy b of this form to the recipient by february 1,. Fill out the nonemployee compensation. You must file this report with the irs if you paid $600 to a freelancer, independent contractor, or other individual or business who provided services to your company during the year. Boxes on the left side of the form require the payer and recipient details such as tin,.What Is Form 1099NEC?

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Form1099NEC

Form 1099NEC Nonemployee Compensation, Recipient Copy B

1099NEC Recipient Copy B Cut Sheet HRdirect

How to File Your Taxes if You Received a Form 1099NEC

Understanding 1099 Form Samples

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

Fill out a 1099NEC

What the 1099NEC Coming Back Means for your Business Chortek

Related Post:

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)