Irs Approved Mileage Log Printable

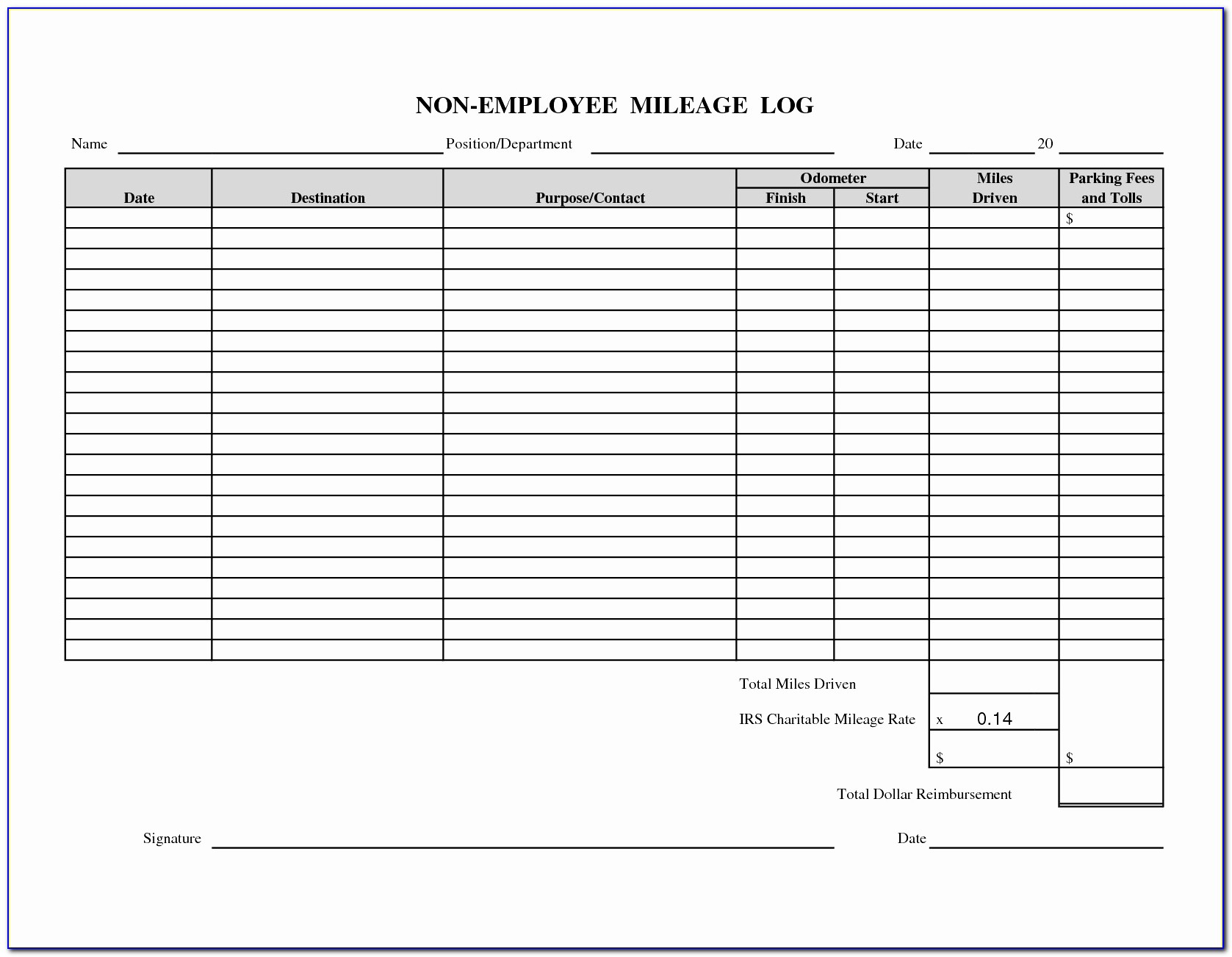

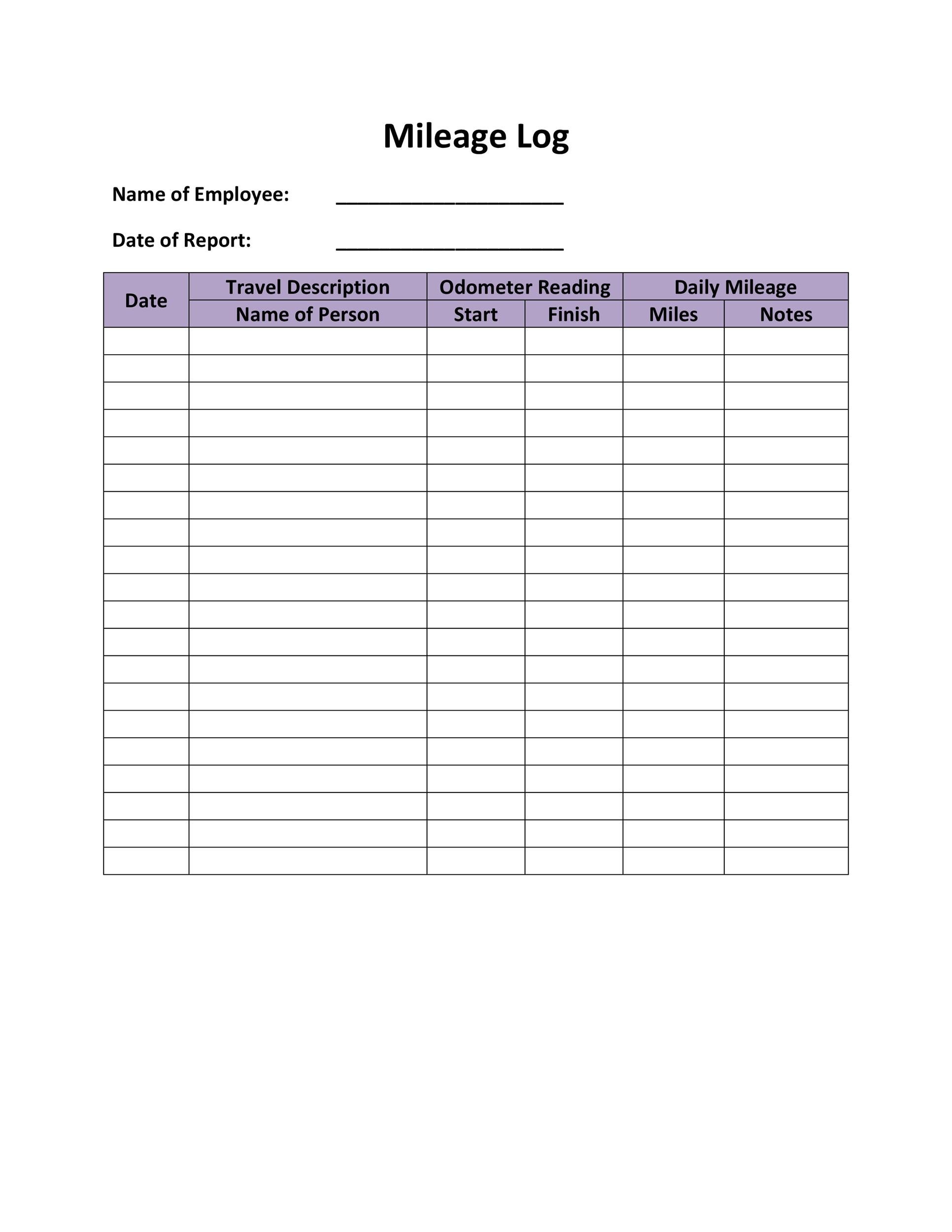

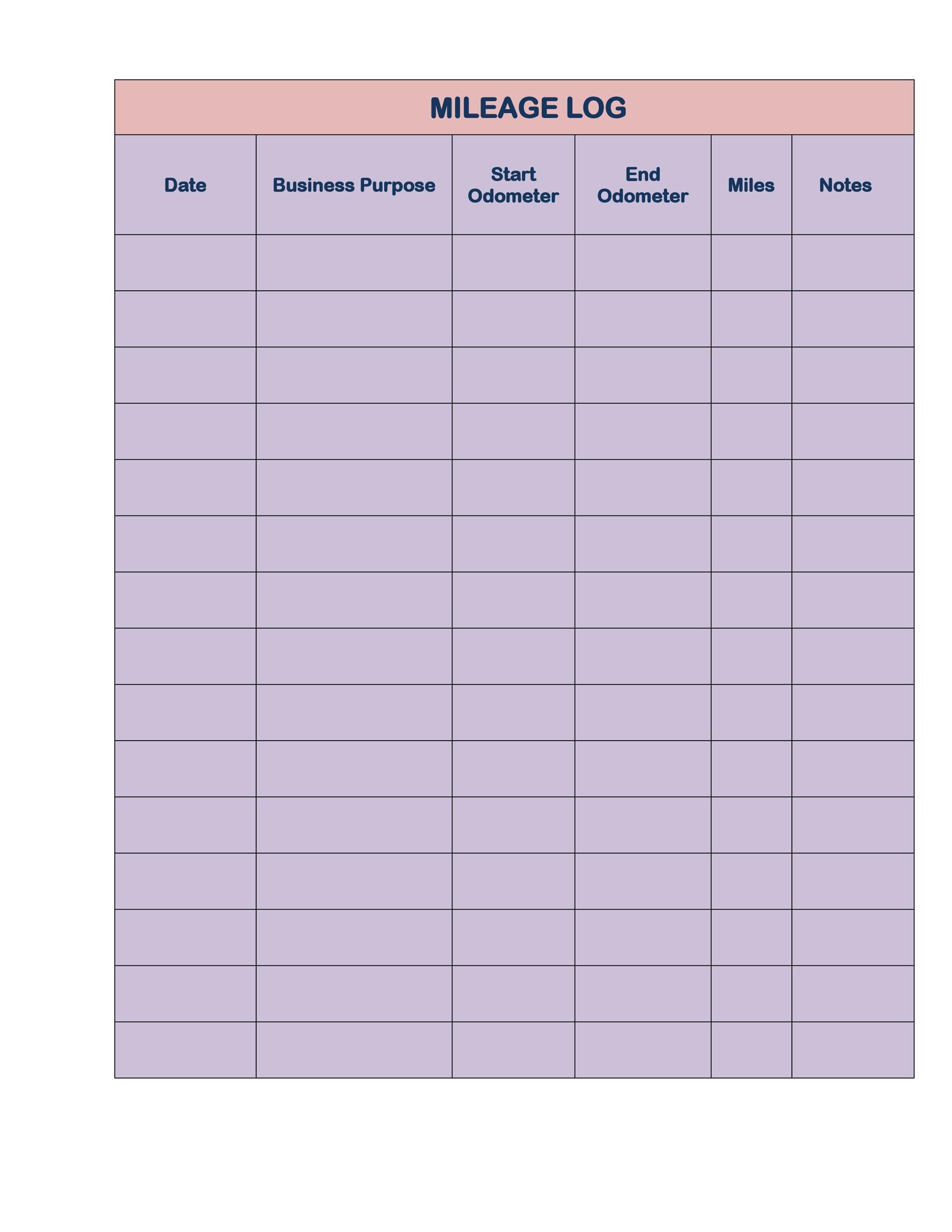

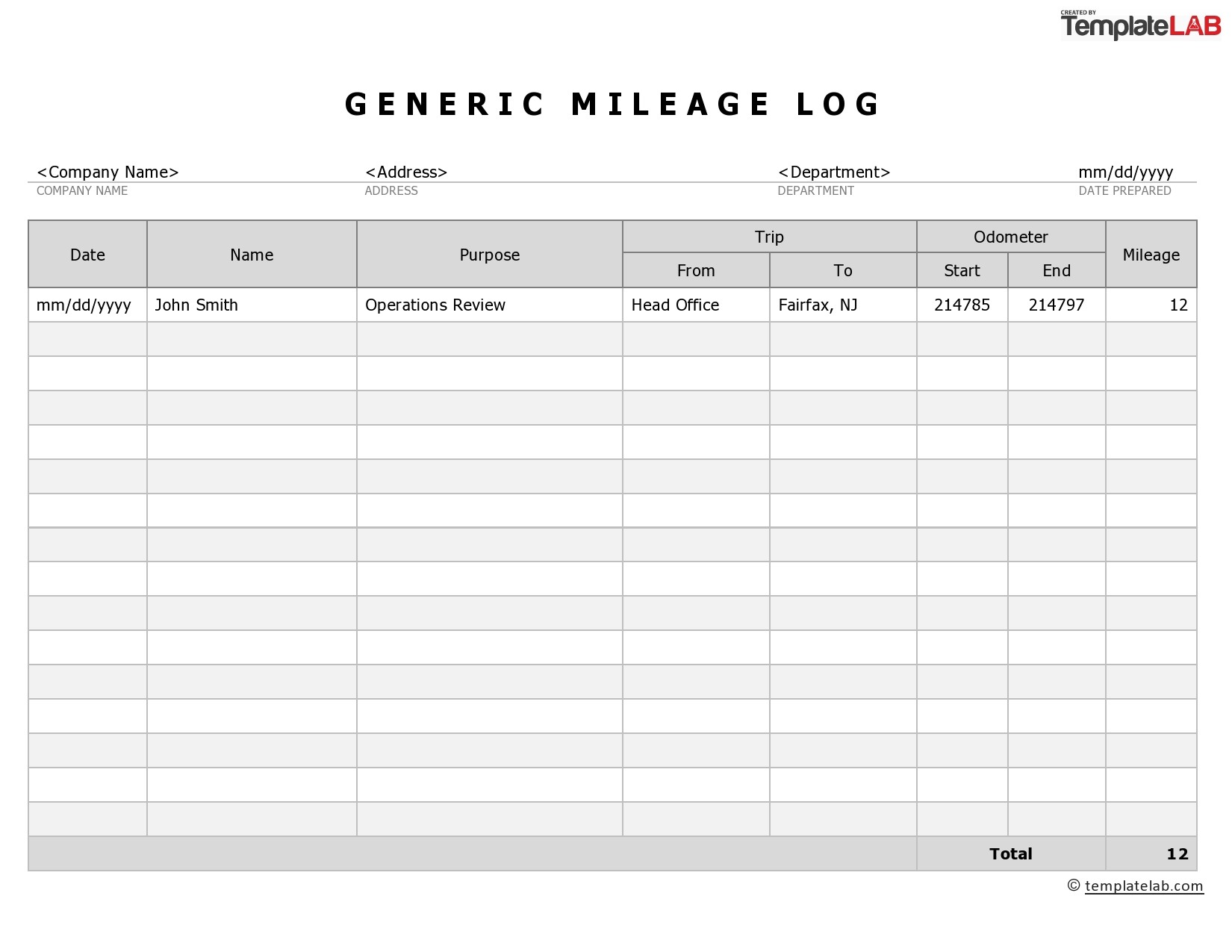

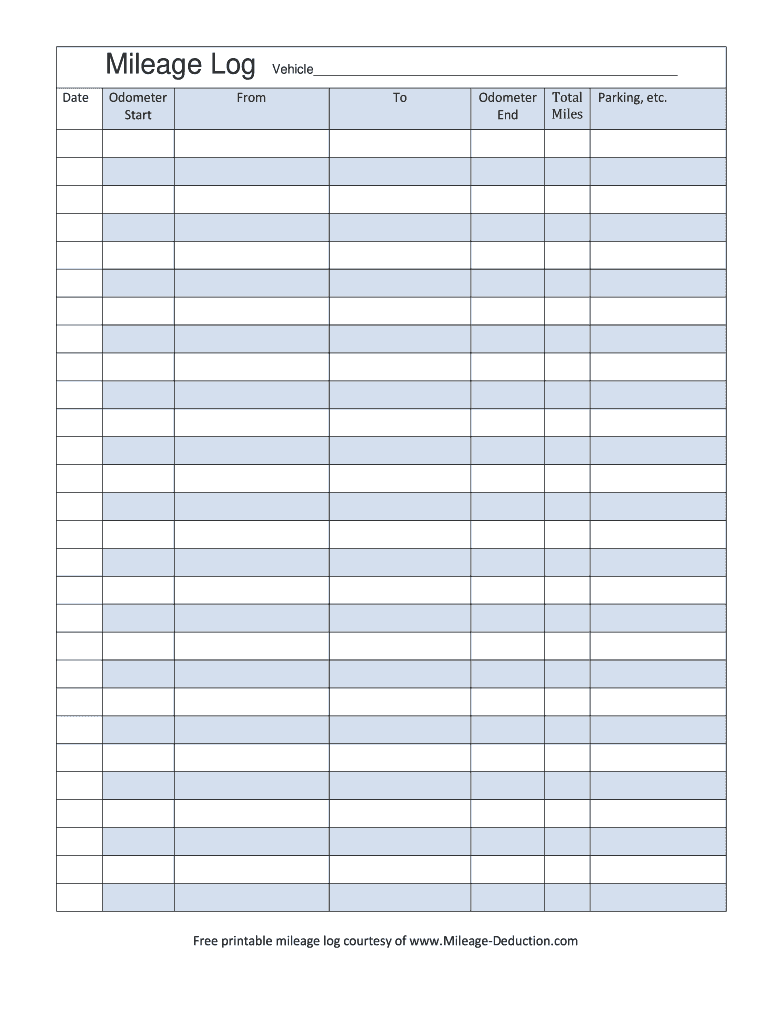

Irs Approved Mileage Log Printable - Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently. Web these free excel mileage logs contain everything you need for a compliant irs mileage log. Web updated february 3, 2023 looking for a painless way to track your business mileage? Web there are 2 ways for account for the mileage deduction amount and i’m to to show you and, along with other. You can use them as per your convenience without the slightest hindrance. Web irs mileage log form total mileage recorded: However, if the irs denies your free printable mileage log, then the average tax bill with penalties and. Many people record the time weekly or. Web avail of the best irs mileage log templates on the internet! Web business 20 mileage log templates if driving is part of your job, you qualify to get federal income tax reductions. Web business 20 mileage log templates if driving is part of your job, you qualify to get federal income tax reductions. Web at $15/hr that’s $189. Web a mileage log template can come in the form of a printed sheet or as a digital spreadsheet. Web requirements for the standard mileage rate. Web our free mileage log templates will enable. To claim deductions on your tax returns, you have to keep meticulous records of your driving. Web if you qualify to use both methods, you may want to figure your deduction both ways before choosing a. There are many places on. Getting from one workplace to another in the course of your. Web there are 2 ways for account for. Web there are 2 ways for account for the mileage deduction amount and i’m to to show you and, along with other. Web according to the irs, mileage can be reimbursed when: To meet the conditions, each log must include: Getting from one workplace to another in the course of your. Web irs issues standard mileage rates for 2021. Web according to the irs, mileage can be reimbursed when: Web for standard mileage rate: Web if you qualify to use both methods, you may want to figure your deduction both ways before choosing a. I’d like to introduce you to the last. There are many places on. Web irs mileage log form. Web avail of the best irs mileage log templates on the internet! Web if you qualify to use both methods, you may want to figure your deduction both ways before choosing a. Web there are 2 ways for account for the mileage deduction amount and i’m to to show you and, along with other. Web. However, the qualification to get the. Web requirements for the standard mileage rate. Print it out, put it in your. There are many places on. I’d like to introduce you to the last. Many people record the time weekly or. To claim deductions on your tax returns, you have to keep meticulous records of your driving. To qualify to use the standard mileage rate according to the irs, you. Web business 20 mileage log templates if driving is part of your job, you qualify to get federal income tax reductions. Web at $15/hr. To claim deductions on your tax returns, you have to keep meticulous records of your driving. To meet the conditions, each log must include: Getting from one workplace to another in the course of your. Web what is a mileage log? Web according to the irs, mileage can be reimbursed when: Many people record the time weekly or. Web requirements for the standard mileage rate. Web irs mileage log form total mileage recorded: I’d like to introduce you to the last. To qualify to use the standard mileage rate according to the irs, you. Web avail of the best irs mileage log templates on the internet! Web if you qualify to use both methods, you may want to figure your deduction both ways before choosing a. Getting from one workplace to another in the course of your. However, if the irs denies your free printable mileage log, then the average tax bill with penalties. However, if the irs denies your free printable mileage log, then the average tax bill with penalties and. Getting from one workplace to another in the course of your. Web irs mileage log form total mileage recorded: Web irs mileage log form. To claim deductions on your tax returns, you have to keep meticulous records of your driving. Web according to the irs, mileage can be reimbursed when: Web for standard mileage rate: You can use them as per your convenience without the slightest hindrance. Web requirements for the standard mileage rate. Web our excel mileage log template meets irs requirements, meaning it contains all the information the irs expects to see in the. To meet the conditions, each log must include: However, the qualification to get the. Web avail of the best irs mileage log templates on the internet! Web if you qualify to use both methods, you may want to figure your deduction both ways before choosing a. Www.gofar.co when you’re ready to make life easier, get gofar! To qualify to use the standard mileage rate according to the irs, you. Many people record the time weekly or. Web irs issues standard mileage rates for 2021. Web there are 2 ways for account for the mileage deduction amount and i’m to to show you and, along with other. Web these free excel mileage logs contain everything you need for a compliant irs mileage log.Mileage Log Template Excel Excel Templates

Irs Mileage Log Template Excel For Your Needs

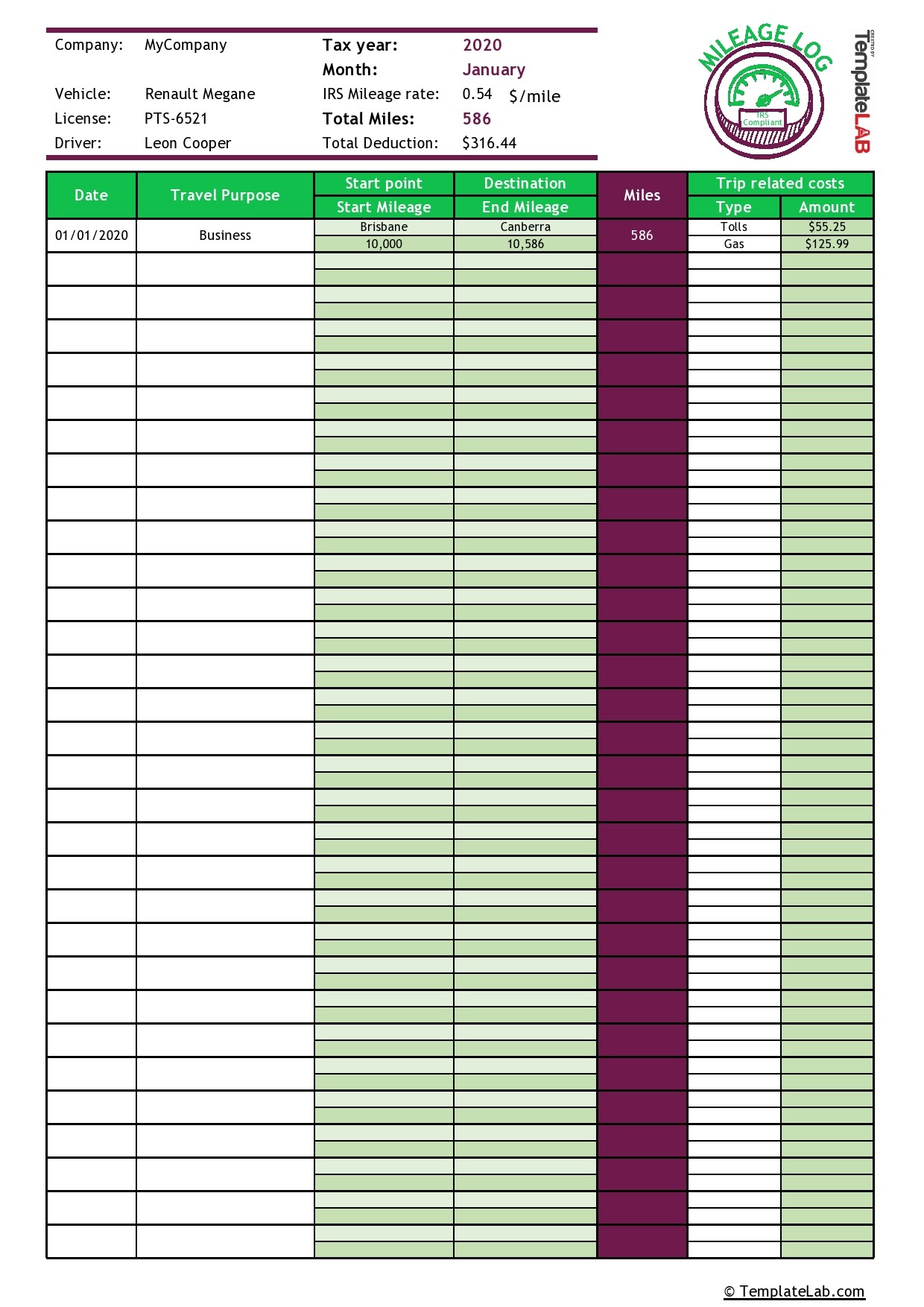

30 Printable Mileage Log Templates (Free) Template Lab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

31 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Irs Mileage Log Template shatterlion.info

25 Printable Irs Mileage Tracking Templates Gofar In Mileage Report

Irs Mileage Log Template BestTemplatess BestTemplatess

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

Related Post: