Irs Form 843 Printable

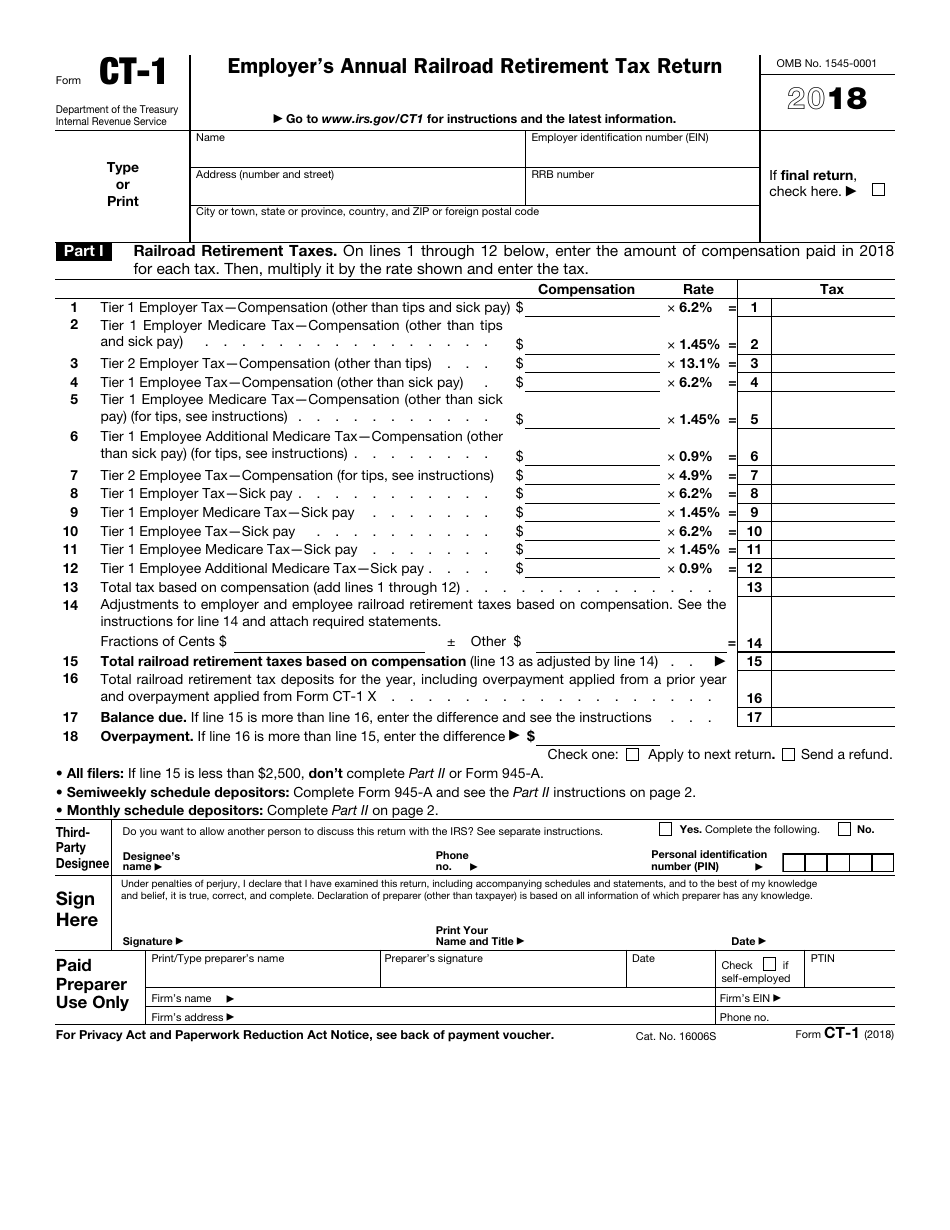

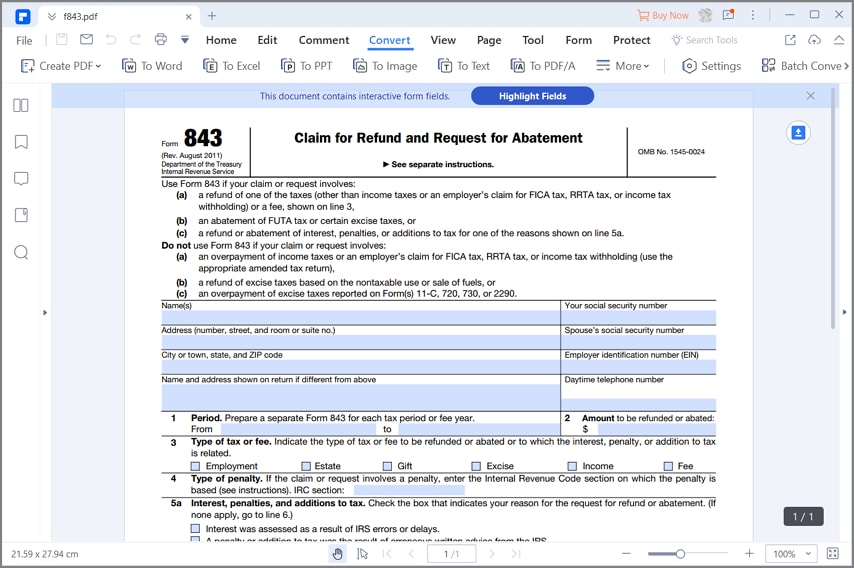

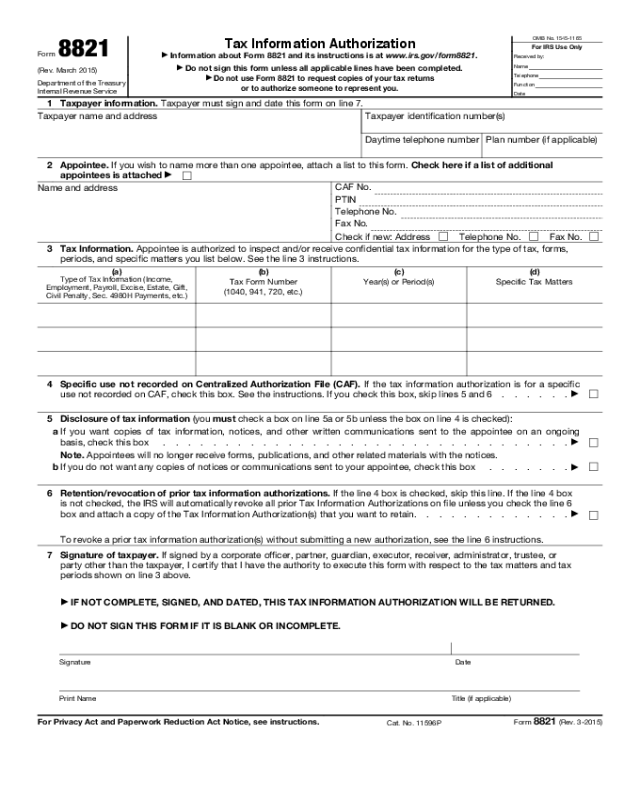

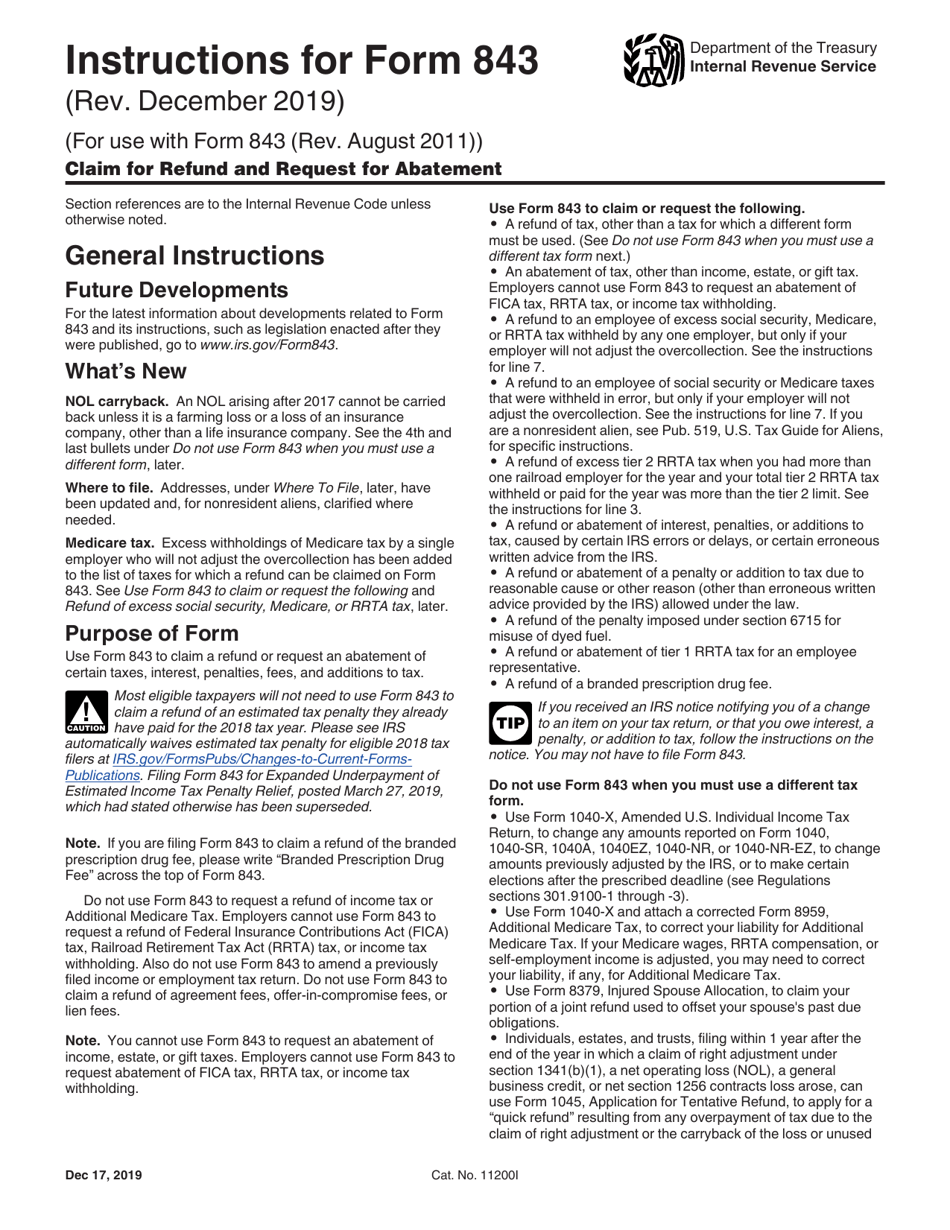

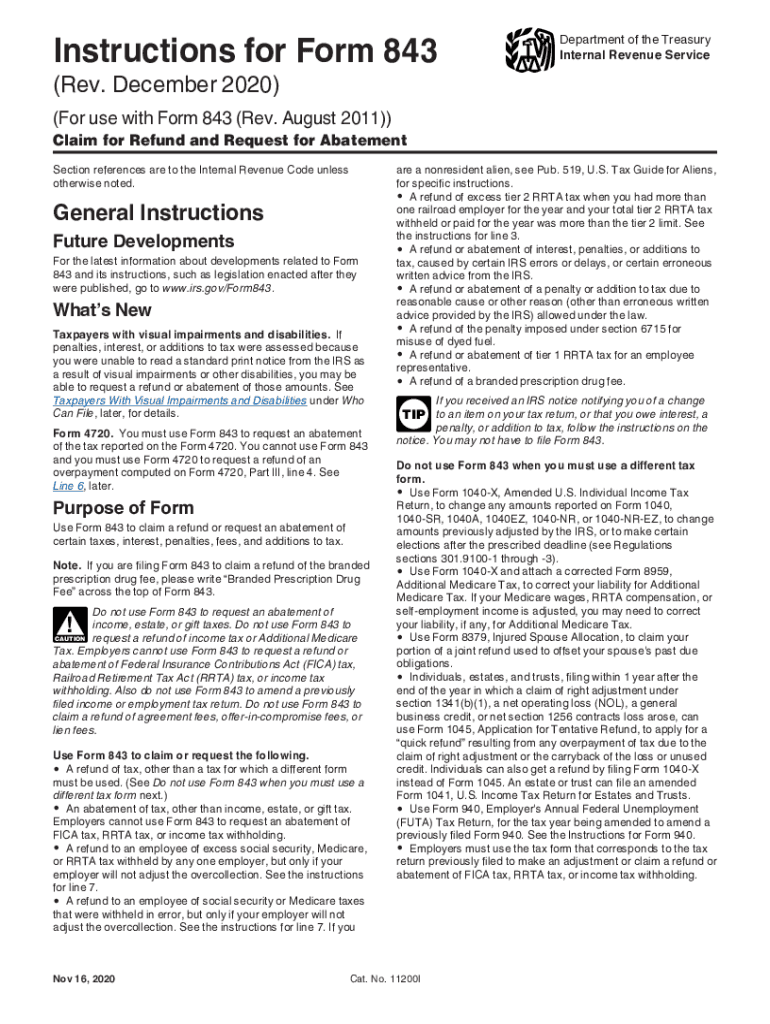

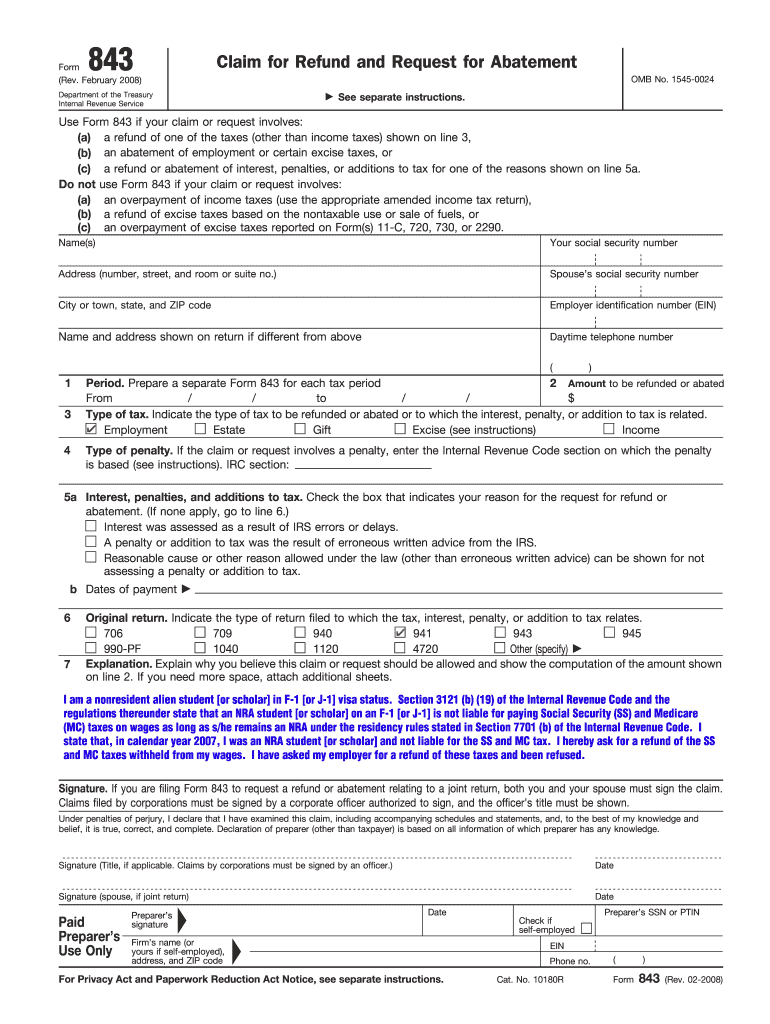

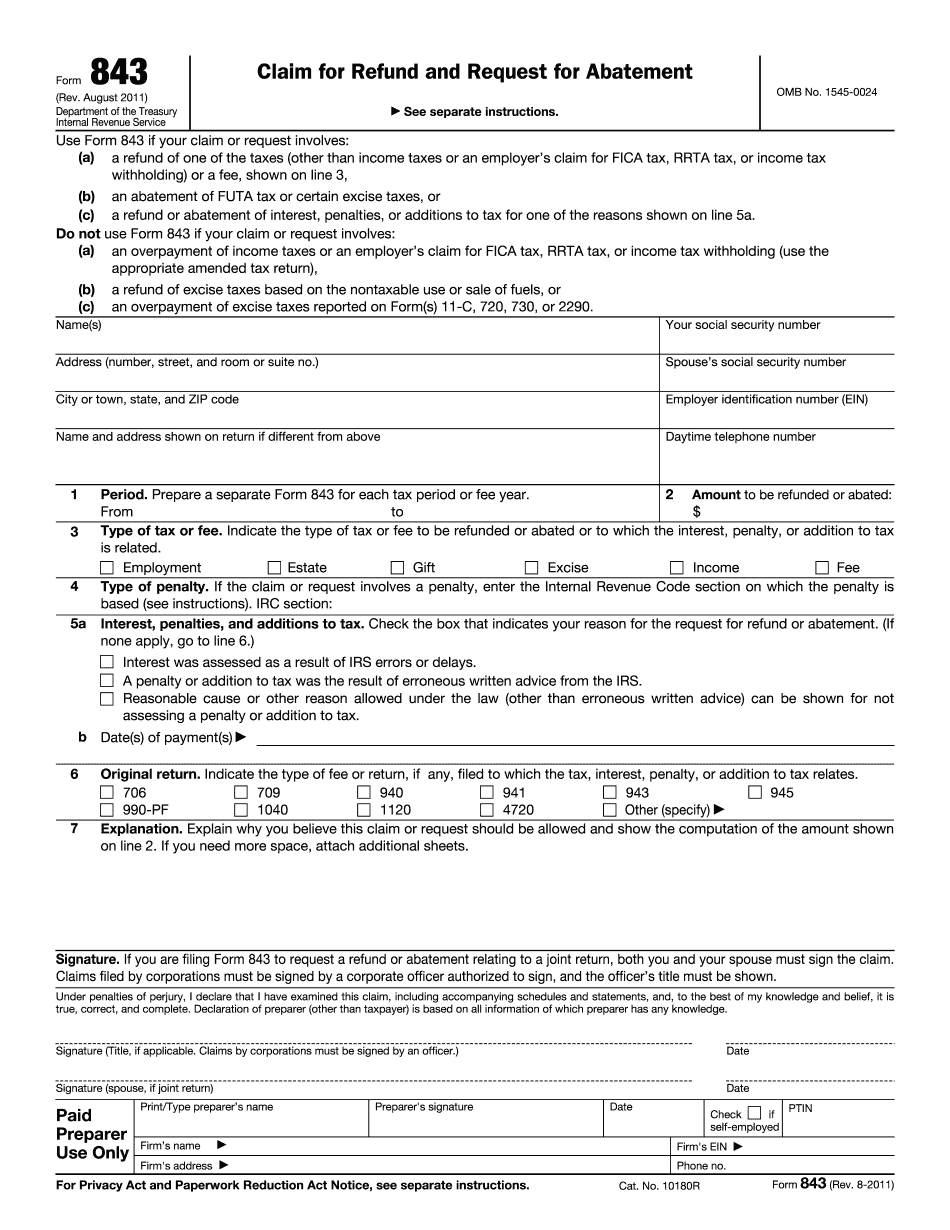

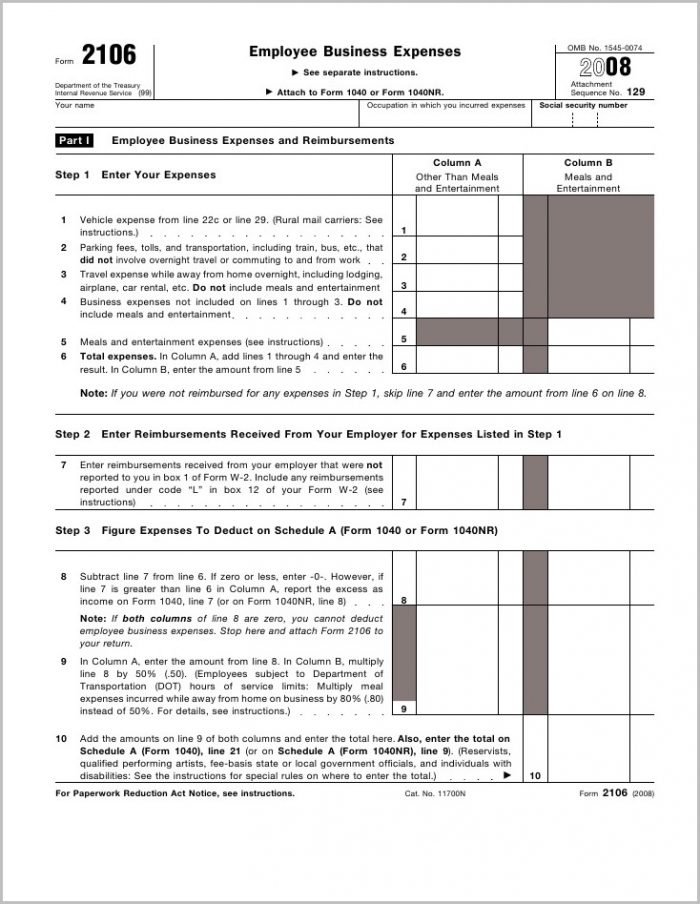

Irs Form 843 Printable - Web use form 843 if your claim or request involves: Instructions & details purposes of irs form 843 you can use form 843 to. Web form 843 is the “claim for refund and request for abatement.” it asks the internal revenue service (irs) for. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate. Web irs form 843 (request for abatement & refund): If you are filing form 843. Web what makes the irs form 843 printable legally valid? Web solved • by intuit • proconnect tax • 3 • updated july 14, 2022. Web get 📝 printable irs form 843 claim for refund and request for abatement for 2020 ☑️ all blank template samples in pdf, doc,. You can get the irs form 843 from the official website of department of the treasury, internal revenue service. Web form 843 is the “claim for refund and request for abatement.” it asks the internal revenue service (irs) for. If you are filing form 843. In response to an irs notice. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate. Web information about form 843, claim. In response to an irs notice. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate. Web request a refund of tax penalties and interest penalties that you have already paid. Web 4.7 satisfied 233 votes what makes the form 843 turbotax legally valid? (a) an overpayment of. Use form 843 to claim a refund or request an abatement of. Web what makes the irs form 843 printable legally valid? Web use form 843 if your claim or request involves: You can get the irs form 843 from the official website of department of the treasury, internal revenue service. Request abatement due to incorrect written advice. Use form 843 to claim a refund or request an abatement of. In response to an irs notice. If you are filing form 843. Web use form 843 if your claim or request involves: Web what makes the irs form 843 printable legally valid? Web get 📝 printable irs form 843 claim for refund and request for abatement for 2020 ☑️ all blank template samples in pdf, doc,. In response to an irs notice. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate. Use form 843 to claim a refund or. Web get 📝 printable irs form 843 claim for refund and request for abatement for 2020 ☑️ all blank template samples in pdf, doc,. Web form 843 is the “claim for refund and request for abatement.” it asks the internal revenue service (irs) for. Then mail the form to…. Web we last updated federal form 843 in february 2023 from. Web what makes the irs form 843 printable legally valid? Web get 📝 printable irs form 843 claim for refund and request for abatement for 2020 ☑️ all blank template samples in pdf, doc,. Web fill online, printable, fillable, blank form 843: Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions. Web request a refund of tax penalties and interest penalties that you have already paid. Web form 843 is the “claim for refund and request for abatement.” it asks the internal revenue service (irs) for. Claim for refund and request for abatement (irs) form. Web 4.7 satisfied 233 votes what makes the form 843 turbotax legally valid? Web mailing addresses. Web use form 843 if your claim or request involves: Web information about form 843, claim for refund and request for abatement, including recent updates, related forms. Then mail the form to…. If you are filing form 843. Web irs form 843 (request for abatement & refund): Web irs form 843 (request for abatement & refund): Web mailing addresses for form 843. Web request a refund of tax penalties and interest penalties that you have already paid. Web what makes the irs form 843 printable legally valid? Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions. (a) an overpayment of income taxes or an employer’s claim for fica tax,. Instructions & details purposes of irs form 843 you can use form 843 to. Use form 843 to claim a refund or request an abatement of. Web get 📝 printable irs form 843 claim for refund and request for abatement for 2020 ☑️ all blank template samples in pdf, doc,. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Web information about form 843, claim for refund and request for abatement, including recent updates, related forms. Web request a refund of tax penalties and interest penalties that you have already paid. Web fill online, printable, fillable, blank form 843: Web edit, sign, and share irs form 843 online. Request abatement due to incorrect written advice. Web irs form 843 (request for abatement & refund): Then mail the form to…. Web mailing addresses for form 843. This form is for income. Web solved • by intuit • proconnect tax • 3 • updated july 14, 2022. Web you can use form 843 to request a refund or an abatement of interest, penalties, and additions to tax that relate. Web we last updated federal form 843 in february 2023 from the federal internal revenue service. Web what makes the irs form 843 printable legally valid? Web form 843 is the “claim for refund and request for abatement.” it asks the internal revenue service (irs) for. Web irs form 843 get form now edit fill out sign export or print download your fillable irs form 843 in pdf table of contents how to.2018 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

IRS Form CT1 Download Fillable PDF or Fill Online Employer's Annual

IRS Form 843 ausfüllen PDF

2023 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Download Instructions for IRS Form 843 Claim for Refund and Request for

IRS Instruction 843 20202021 Fill out Tax Template Online US Legal

i843 Tax Refund Irs Tax Forms

Form 843 (Rev. February 2008). Claim for Refund and Request for

Manage Documents Using Our Form Typer For IRS Form 843

Irs Form 1040 Line 6d Exemptions Form Resume Examples

Related Post: